Compare Top Policies to Find the Best Grocery Store Insurance in California

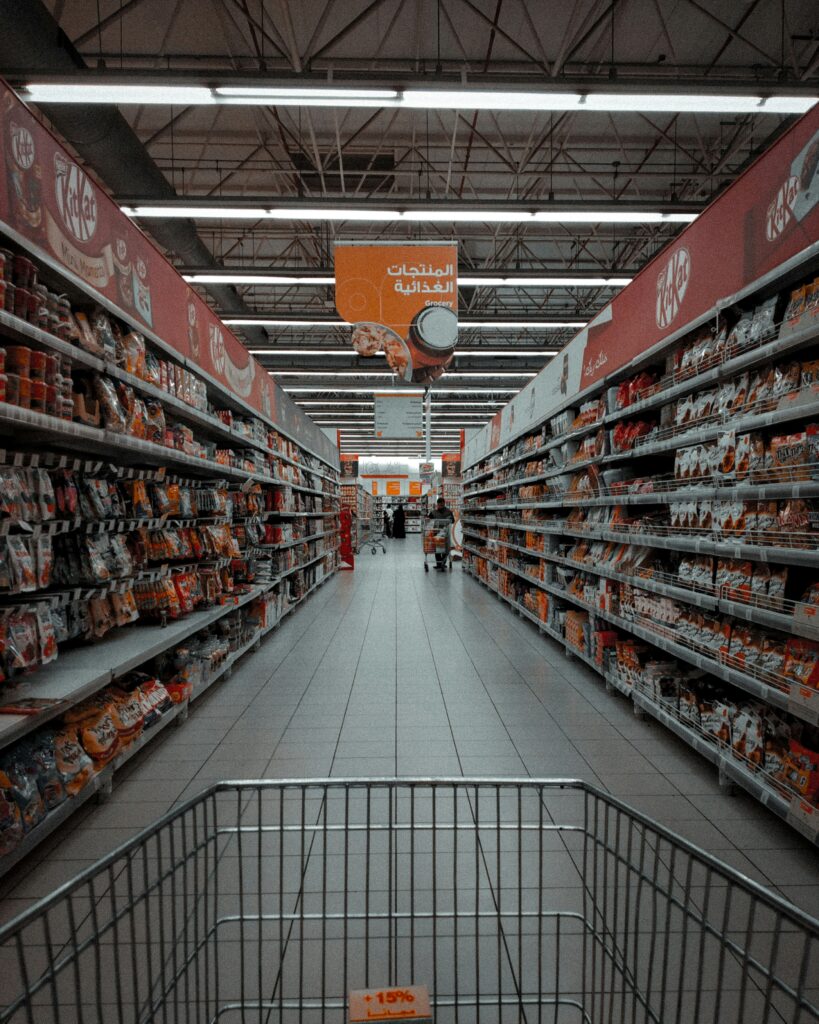

Choosing the right insurance for your grocery business isn’t just about price—it’s about value, protection, and peace of mind. At Insurance, we make it easy for grocery store owners to make the best decision by offering a transparent and in-depth grocery store insurance comparison across multiple carriers and policy types.

Whether you operate a small independent grocery shop in California or manage a growing chain across the USA, our comparison tools and expert advisors help you understand what coverage options are available and which ones offer the best balance of cost and protection.

Coverage &

Policies

Discount

Want to make a Claim?

What Should You Compare?

When comparing grocery store insurance plans, it’s important to look beyond just monthly premiums. Key factors include:

If your grocery store has a physical location and deals with foot traffic, inventory, and employees, a Business Owner’s Policy grocery store is a smart investment.

Why Comparing Grocery Insurance Matters

Most business owners simply look at price—but that’s not enough. The best grocery store insurance in California balances affordability, reliability, and risk-specific protection. By comparing policies, you can avoid:

Being underinsured when disaster strikes

Overpaying for unnecessary coverage

Delays or rejections during claims

Legal liabilities from coverage gaps

Our goal is to help you find a policy that’s cheap but comprehensive, especially in a competitive state like California.

Grocery Store Insurance Comparison

Compare Grocery Store Insurance Policies to Find the Best Fit in California and Across the USA

When it comes to protecting your grocery business, not all insurance plans are created equal. As a store owner, you need more than just the cheapest policy—you need coverage that matches your risk, budget, and operations. That’s where Western Insurance comes in. We help you make informed decisions through side-by-side grocery store insurance comparisons, offering real advice, clear pricing, and tailored solutions.

Whether you operate a small ethnic store in Los Angeles, a mid-sized franchise in Sacramento, or an independent grocery shop in Texas or New York, our expert agents will guide you to the best grocery store insurance options available in your region.

Coverage Types to Compare

General Liability Insurance for Grocery Stores

Covers third-party injuries, property damage, and lawsuits from slips, trips, or food-related incidents.

Grocery Store Property and Liability Insurance

Protects inventory, cash registers, shelves, refrigeration, and your physical building from fire, theft, and natural disasters.

Grocery Store Workers Compensation Insurance

Required in most states (especially California) to protect employees injured on the job.

Grocery Store BOP Insurance

A Business Owner’s Policy combines liability and property into one discounted policy ideal for small and medium-sized grocers.

Grocery Store Spoilage Insurance California

Protects refrigerated goods and perishables in case of equipment breakdown or power failure.

Grocery Store Equipment Insurance CA

Covers coolers, ovens, scales, and point-of-sale (POS) systems from mechanical breakdown or damage.

Compare quotes and get life insurance in right way

Still have you any problem for solutions?

Get personalized support from experienced agents. Whether you’re looking for insurance for independent grocers, retail grocery store property coverage, or just need advice on policy types, we’re here to help.

Compare grocery store insurance quotes or speak with a local expert today.

Head office address:

9340 Bolsa Avenue

Westminster, CA 92683