Small Grocery Store Insurance

Coverage &

Policies

Discount

Want to make a Claim?

What’s Included in Small Grocery Store Coverage?

We recommend combining these into a Business Owner’s Policy (BOP) for more coverage at a lower premium. Learn more here:

👉 BOP Insurance California

General Liability Insurance for Small Grocery Stores

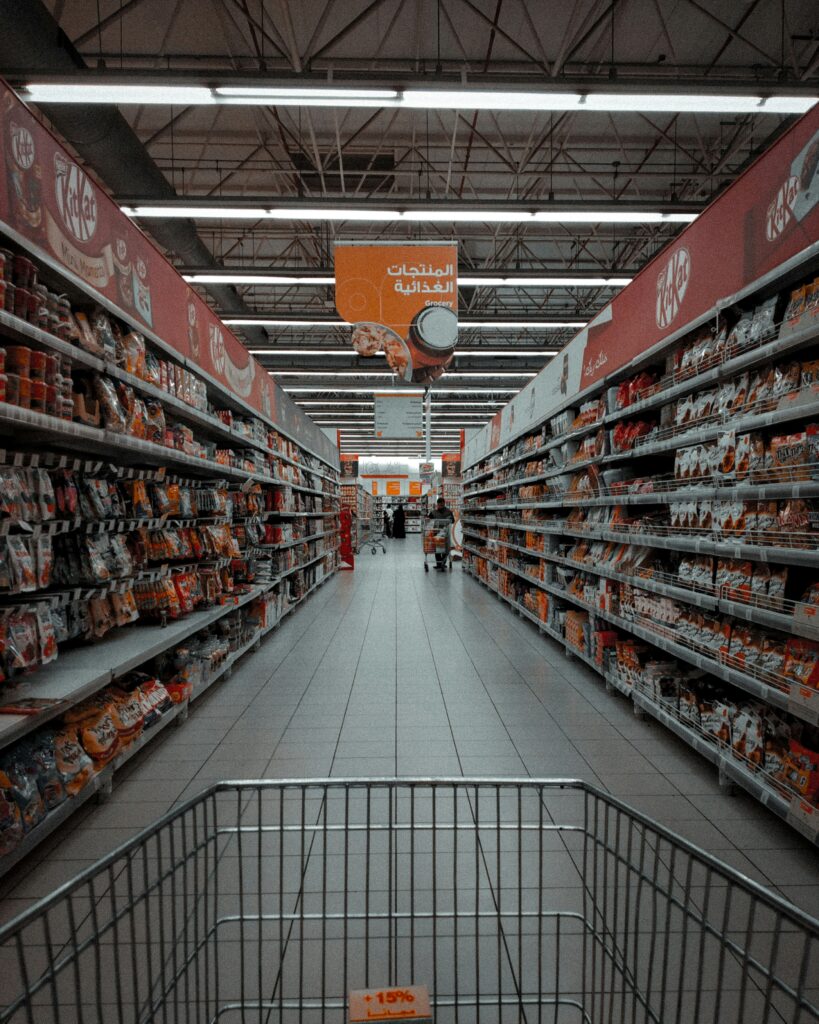

Running a small grocery store comes with daily risks such as customer injuries, property damage, and product-related claims. General Liability Insurance protects your business from legal expenses and unexpected incidents, ensuring financial stability while you focus on serving your community.

Small grocery stores often face hazards like slip-and-fall accidents, shelving mishaps, or accidental damage to products. With general liability coverage, owners can manage these risks effectively, helping maintain smooth operations without disruptions.

Investing in general liability insurance also builds trust with customers, suppliers, and business partners. For more information, visit General Liability Insurance California

Business Owner’s Policy (BOP) for Small Grocery Stores

A Business Owner’s Policy (BOP) offers combined protection for property and liability, making it ideal for small grocery stores. This policy safeguards your inventory, equipment, and storefront against risks such as fire, theft, vandalism, and spoilage.

Small grocery stores often manage perishable goods and limited inventory. A BOP can be customized to include coverage for equipment breakdown, spoilage, and business interruption, ensuring your store remains financially secure during unforeseen events.

Having a BOP policy protects your assets and supports day-to-day operations. Learn more about tailored small grocery store insurance plans at Western Insurance

Workers’ Compensation Insurance for Small Grocery Stores

Employees in small grocery stores face risks like heavy lifting, handling perishable items, or operating store equipment. Workers’ Compensation Insurance ensures that staff receive medical care and wage replacement if injured on the job, keeping your business compliant with California regulations.

Proper workers’ comp coverage reduces financial liability and demonstrates your commitment to employee safety. It applies to cashiers, stock clerks, and delivery personnel working in small store environments.

Protect your team and maintain compliance with a workers’ compensation plan designed for small grocery stores. For more details, visit Workers’ Compensation Insurance California

Compare quotes and get life insurance in right way

Still have you any problem for solutions?

Head office address:

9340 Bolsa Avenue

Westminster, CA 92683